#Module Level Power Electronics market Analysis

Explore tagged Tumblr posts

Text

https://heyjinni.com/read-blog/231239_investment-and-financial-landscape-of-the-mlpe-market.html

#Module Level Power Electronics (MLPE) Market Scope#Module Level Power Electronics (MLPE) Market Analysis#Module Level Power Electronics (MLPE) Market Report

0 notes

Text

Understanding the Cummins X15 Price: A Comprehensive Guide for Truck Owners

1. Overview of the Cummins X15 Engine

The Cummins X15 engine is a pinnacle of modern diesel engine technology, specifically designed for heavy-duty trucks. With its robust construction and advanced engineering, the X15 engine plays a critical role in maximizing efficiency and performance in the trucking industry. Truck owners often seek to understand the cummins x15 price to ensure they make informed purchase decisions.

1.1 Key Features and Specifications

The Cummins X15 is equipped with a variety of features that enhance its performance, such as:

Displacement: 15 liters

Horsepower Range: 400 to 605 hp

Torque Range: 1450 to 1850 lb-ft

Engine Type: Inline-6 turbocharged

Fuel System: High-pressure common rail

Emissions Control: Compliant with EPA regulations, utilizing SCR technology for reduced emissions

This combination of features enables the Cummins X15 to deliver impressive power and efficiency, making it a popular choice among truck manufacturers and operators alike.

1.2 Benefits of the Cummins X15

The Cummins X15 offers numerous benefits that appeal to trucking professionals:

Enhanced Fuel Efficiency: The engine is designed to achieve optimal fuel efficiency, leading to lower operational costs.

Reliability: Cummins engines are known for their durability, ensuring long lifespans even under rigorous conditions.

Advanced Technology: Incorporating advanced technology such as Cummins’ Electronic Control Module (ECM) helps in maximizing performance and engine management.

Low Maintenance Costs: The X15 boasts lower maintenance needs compared to its competitors, further reducing total cost of ownership.

1.3 Common Applications in Heavy Trucks

The Cummins X15 engine is utilized widely across several heavy-duty truck applications, including:

Long-haul transportation

Construction and mining trucks

Heavy-duty freight carriers

Dump trucks and vocational vehicles

Its versatility enables it to perform effectively in various environments, catering to different operational needs.

2. Factors Influencing the Cummins X15 Price

Understanding the factors influencing the price of the Cummins X15 is vital for making a sound investment. Several elements contribute to price variation in the market.

2.1 Market Trends and Demand

Market trends play a significant role in determining prices. The demand for heavy-duty trucks has seen fluctuations based on economic conditions, regulatory changes, and advancements in technology. When there is an increase in demand for trucks fitted with the Cummins X15, prices can rise accordingly. Conversely, economic downturns or oversupply of engines can lead to lowered prices.

2.2 Condition and Mileage Considerations

The condition of the engine, whether new or used, significantly impacts the price. New X15 engines command a higher price due to their warranty, performance guarantee, and the latest technology. Used engines, on the other hand, are assessed based on mileage, maintenance history, and overall condition. A well-maintained engine with lower mileage may retain a higher resale value.

2.3 Regional Price Variations

Regional factors also influence the pricing of the Cummins X15 engine. Different states or countries may have varying levels of demand, availability, and shipping costs, affecting overall pricing. Areas with a higher density of trucking operations may see a more competitive pricing landscape due to economic activity and demand.

3. Comparing Cummins X15 with Competitors

To fully understand the value of the Cummins X15 engine, it’s essential to compare it with similar offerings in the market.

3.1 Pricing Analysis of Similar Engines

Engines like the Detroit Diesel DD16 and PACCAR MX-13 often compete with the Cummins X15. Pricing varies based on specifications and technology, but generally, Cummins is positioned competitively, offering robust features at a similar price point. A comprehensive pricing analysis shows that while the X15 may be slightly higher in some cases, the long-term fuel savings and reliability make it a worthy investment.

3.2 Performance Metrics Compared

Performance is another essential aspect to evaluate. The diesel engines in competition with the X15 generally show similar horsepower and torque capabilities. However, Cummins often leads in areas such as fuel efficiency and emissions control, aligning with modern environmental standards. Performance metrics like fuel consumption rates, maintenance schedules, and downtime also highlight the X15’s competitive edge.

3.3 Customer Satisfaction and Reliability

Customer satisfaction is an invaluable metric to consider. Surveys and reviews consistently depict the Cummins X15 as a reliable choice, backed by the brand’s reputation for durability. Feedback regarding serviceability and dealership support also demonstrates that Cummins offers excellent customer service, contributing to its high ratings among users.

4. Tips for Finding the Best Cummins X15 Price

To secure the best pricing on a Cummins X15 engine, truck owners can consider the following strategies.

4.1 Where to Buy: New vs. Used

Deciding between new and used engines is crucial in finding the best price. New engines come with full warranties and the latest technology, usually resulting in lower maintenance costs. Used engines may save upfront costs but require thorough inspections. Understand your operational needs and budget constraints before deciding.

4.2 Negotiation Strategies with Dealers

When approaching dealers, negotiation skills can significantly impact the final price. Researching prices, understanding the average market value, and identifying potential dealer incentives can provide leverage during discussions. Being prepared to walk away can also help in negotiating better terms.

4.3 Evaluating Warranty Options

A critical component of the purchasing process is assessing warranty options. Strong warranty coverage can protect your investment and reduce long-term costs. Compare different options, looking for comprehensive coverage that addresses your operational needs, mileage, and potential repairs.

5. Conclusion: Making an Informed Purchase Decision

Making an informed purchasing decision involves understanding the intricacies of the Cummins X15 engine and its pricing dynamics.

5.1 Recap of Key Insights

In summary, the Cummins X15 engine stands out due to its advanced features, reliability, and customer satisfaction ratings. Price factors include market trends, engine condition, and regional availability. Compared to competitors, the X15 holds its ground well in performance and overall value.

5.2 Future Trends in Engine Pricing

As technology continues to advance, future pricing trends may reflect an increase in demand for fuel-efficient and environmentally friendly engines. Monitoring industry developments and economic changes will be crucial for buyers looking to keep abreast of pricing dynamics.

5.3 Resources for Truck Owners

Truck owners seeking further information can benefit from industry publications, forums, and manufacturer websites. Engaging with online communities can provide insights from experienced operators and help in making informed decisions regarding engine purchases.

1 note

·

View note

Text

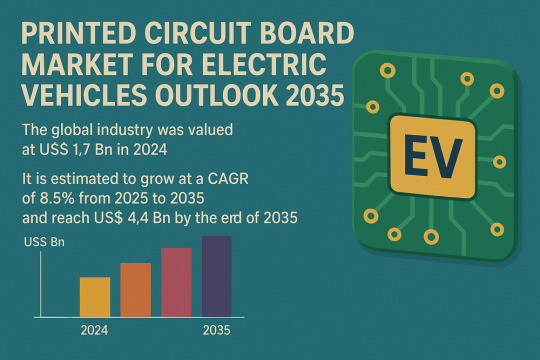

Smart Mobility Drives Smart PCBs: Market to Hit $4.4Bn by 2035

The global Printed Circuit Board (PCB) Market for Electric Vehicles (EVs) is set to witness significant expansion over the next decade, according to the latest market analysis. Valued at US$ 1.7 billion in 2024, the market is projected to grow at a CAGR of 8.5% from 2025 to 2035, reaching a valuation of US$ 4.4 billion by the end of the forecast period.

Market Overview: Printed Circuit Boards (PCBs) are the electronic backbone of electric vehicles, enabling power distribution, connectivity, and control across critical systems such as battery management, motor control, infotainment, and advanced safety features. With EV adoption accelerating globally, PCBs have become essential to the performance, reliability, and innovation of next-generation vehicles.

Market Drivers & Trends

One of the primary drivers of this market is the growing investment and strategic partnerships in the EV supply chain. Leading automakers and electronics companies are heavily investing in R&D and manufacturing capacity to meet the increasing demand for high-performance PCBs.

Moreover, the rise of autonomous and connected vehicles has made sophisticated electronics an indispensable part of modern transportation. The proliferation of features like ADAS (Advanced Driver-Assistance Systems), V2X communication, and in-vehicle infotainment is pushing the demand for compact, multi-layer, high-speed, and thermally efficient PCBs.

In 2023, EV sales in the U.S. surged by 60%, while the European Commission invested over US$ 6 billion in EV infrastructure further stimulating demand for advanced PCB solutions.

Latest Market Trends

The industry is witnessing a rapid shift toward flexible and high-density interconnect (HDI) PCBs, which are crucial for compact and space-saving vehicle designs. Flexible PCBs, in particular, are gaining traction in battery management systems and advanced sensor modules due to their lightweight and adaptable nature.

Additionally, regulatory advancements such as the FCC's allocation of the 5.9 GHz band for vehicle safety and autonomous functions have opened doors for new PCB capabilities. Real-time, high-speed data transmission requires advanced PCB materials and multi-layer configurations.

Key Players and Industry Leaders

Some of the most prominent players shaping the global printed circuit board market for electric vehicles include:

ABL CIRCUITS

AT&S Austria Technologie & Systemtechnik Aktiengesellschaft I

Chin Poon Industrial Co., Ltd.

Compeq Manufacturing Co., Ltd.

HannStar Board Corporation

Kinwong Electronic Co. Ltd

LG Innotek

MEIKO ELECTRONICS Co., Ltd.

Nan Ya Printed Circuit Board Corporation

RayMing PCB

Rush PCB Ltd.

SCHWEIZER ELECTRONIC AG

Shenzhen Capel Technology Co., Ltd.

Shenzhen Fastprint Circuit Tech Co., Ltd.

TTM Technologies

Unimicron Technology Corporation

Victory Giant Technology Co., Ltd.

WUS Printed Circuit Co., Ltd.

Young Poong Group

Zhen Ding Tech. Group

Among Others

These companies are prioritizing innovation, expanding global manufacturing footprints, and forging strategic alliances to maintain competitiveness and cater to evolving industry needs.

Download now to explore primary insights from our Report in this sample - https://www.transparencymarketresearch.com/sample/sample.php?flag=S&rep_id=86464

Recent Developments

October 2024 – Mektech Manufacturing announced a 920 million baht investment in Thailand to expand production capacity for flexible PCBs and FPCBA used in electric vehicles.

July 2024 – Omron Electronic Components Europe launched a high-power PCB relay for Level 2 EV charging stations. The innovation features double-break contact designs, enabling reduced heat dissipation and enhanced energy efficiency.

Market Opportunities

The market is poised for significant opportunities, particularly in:

OEM collaborations to co-develop application-specific PCBs for power electronics and smart mobility.

Flexible PCB technology, which is expected to revolutionize EV design with lightweight, customizable circuit boards.

Geographical expansion into regions like South Asia and Latin America, where EV adoption is accelerating, and supply chains are emerging.

Additionally, the ongoing reshoring of PCB manufacturing in regions such as North America and Europe presents untapped potential for local players.

Future Outlook

According to analysts, the convergence of EV electrification, autonomy, and connectivity will demand ever more sophisticated PCB solutions. Next-generation EVs will require PCBs capable of managing 50 Gbps data speeds, robust thermal management, and high signal integrity. Flexible, multilayer, and ceramic PCBs are expected to gain ground rapidly.

As regulations around emissions and vehicle safety become more stringent, automakers will rely heavily on advanced PCB solutions to remain compliant and competitive. From battery optimization to smart in-vehicle systems, the demand for high-performance PCBs is set to skyrocket.

Market Segmentation

The global PCB market for EVs is segmented across several parameters:

By Type: Multilayer (dominant with 73.98% market share in 2024), Double-sided, Single-sided

By Substrate Type: HDI/Micro-via/Build-up, Flexible, Rigid-flex, Rigid 1-2 Sided

By Material: FR4, Metal-Based, Ceramic, PTFE, Power Combi-boards

By Application: ADAS, Battery Management, Powertrain, Lighting & Display, Charging, Connectivity, etc.

By Vehicle Type: Passenger Cars, Buses, Two-Wheelers, Trucks, Off-Highway Vehicles

By End Users: OEMs, Tier 1 & 2 Suppliers, Aftermarket

Regional Insights

East Asia is the undisputed leader in the global market, accounting for 68.3% of the total share in 2024. The region’s dominance stems from:

A well-established electronics manufacturing ecosystem

Government support for EV expansion and green technology

Cost-effective production and high R&D capabilities

Japan, South Korea, and China house the majority of leading PCB suppliers and EV component manufacturers. Their early investment in automation and material innovation is positioning East Asia as the global hub for EV electronics.

Other key regions include:

North America, driven by government initiatives like the CHIPS Act

Europe, focused on sustainable manufacturing and reducing supply chain reliance on Asia

South Asia, emerging as a low-cost, high-volume manufacturing zone

Why Buy This Report?

This in-depth industry report offers:

Detailed market sizing and forecast (2020–2035)

Comprehensive segmentation across product, material, vehicle type, and region

Competitive landscape with profiles of 20+ leading companies

Insights into trends, innovations, and regional dynamics

Strategic recommendations for stakeholders, investors, and policymakers

Whether you're an investor, OEM, component supplier, or policy planner, this report serves as a strategic guide to understanding growth dynamics and identifying emerging opportunities in the PCB market for electric vehicles.

Explore Latest Research Reports by Transparency Market Research: Active Optical Cable Market: https://www.transparencymarketresearch.com/active-optical-cables.html

3D Cameras Market: https://www.transparencymarketresearch.com/3d-cameras-market.html

Optoelectronics Market: https://www.transparencymarketresearch.com/optoelectronics-market.html

Machine Safety Market: https://www.transparencymarketresearch.com/machine-safety-market.html

DC-DC Converter OBC Market: https://www.transparencymarketresearch.com/dc-dc-converter-obc-market.html

About Transparency Market Research Transparency Market Research, a global market research company registered at Wilmington, Delaware, United States, provides custom research and consulting services. Our exclusive blend of quantitative forecasting and trends analysis provides forward-looking insights for thousands of decision makers. Our experienced team of Analysts, Researchers, and Consultants use proprietary data sources and various tools & techniques to gather and analyses information. Our data repository is continuously updated and revised by a team of research experts, so that it always reflects the latest trends and information. With a broad research and analysis capability, Transparency Market Research employs rigorous primary and secondary research techniques in developing distinctive data sets and research material for business reports. Contact: Transparency Market Research Inc. CORPORATE HEADQUARTER DOWNTOWN, 1000 N. West Street, Suite 1200, Wilmington, Delaware 19801 USA Tel: +1-518-618-1030 USA - Canada Toll Free: 866-552-3453 Website: https://www.transparencymarketresearch.com Email: [email protected]

0 notes

Text

Transforming Operations with SAP Supply Chain Management

In today's fast-paced and globally connected market, businesses must have agile, responsive, and data-driven supply chains to remain competitive. One of the most powerful tools helping organizations achieve this is SAP Supply Chain Management (SAP SCM). SAP SCM is an advanced solution designed to optimize and integrate every component of the supply chain, enabling businesses to deliver products efficiently, minimize costs, and enhance customer satisfaction.

What is SAP Supply Chain Management?

SAP SCM is part of SAP’s broader suite of enterprise resource planning (ERP) tools. It offers end-to-end visibility and coordination acrosTransforming Operations with SAP Supply Chain Managements all aspects of the supply chain — from planning and sourcing to manufacturing and delivery. By integrating real-time data, predictive analytics, and intelligent automation, SAP SCM allows companies to better forecast demand, manage inventory, streamline logistics, and respond proactively to market changes.

Key Features of SAP SCM

Supply Chain Planning: SAP SCM provides robust tools for demand forecasting, production planning, and capacity management. Its predictive capabilities allow companies to plan resources effectively and reduce overproduction or stockouts.

Supply Chain Execution: This includes modules for warehouse and transportation management, enabling real-time tracking and coordination of goods movement. It helps reduce delivery delays and improves efficiency.

Collaboration: SAP SCM supports seamless collaboration between suppliers, manufacturers, and customers through shared data and integrated workflows. This helps enhance responsiveness and agility.

Analytics and Insights: SAP’s built-in analytics tools help monitor performance, identify bottlenecks, and uncover opportunities for cost savings or service improvements.

Automation and AI Integration: SAP SCM integrates artificial intelligence (AI) and machine learning (ML) to automate routine tasks and offer smart decision-making support.

Benefits of SAP SCM

Implementing SAP Supply Chain Management offers several strategic advantages:

Enhanced Visibility: Real-time data helps businesses make faster, more informed decisions.

Cost Efficiency: By optimizing inventory levels and reducing waste, SAP SCM significantly cuts down operational costs.

Risk Mitigation: With scenario planning and risk analysis features, companies can better prepare for disruptions.

Scalability: SAP SCM can be tailored to fit businesses of all sizes and is scalable as companies grow.

Sustainability: Improved resource management and optimized logistics contribute to more sustainable operations.

Real-World Applications

From manufacturing to retail and logistics, businesses in various sectors use SAP SCM to streamline operations. For instance, a global electronics manufacturer might use it to balance supply and demand across multiple continents, while a retailer can ensure timely restocking and accurate demand forecasting during peak seasons.

Conclusion

SAP Supply Chain Management is more than just a software solution—it's a strategic tool that transforms how companies operate in a dynamic global environment. By integrating key supply chain functions and enabling smarter decisions through data, SAP SCM empowers organizations to build more resilient, efficient, and customer-centric operations.

Whether you're looking to reduce costs, enhance agility, or drive growth, SAP SCM provides the tools and insights needed to make your supply chain a competitive advantage.

0 notes

Text

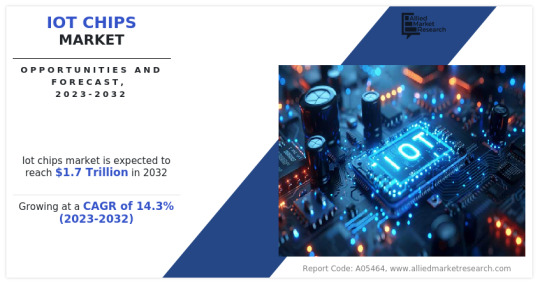

IoT Chips Market to Register Substantial Expansion By 2032

Allied Market Research, titled “IoT Chips Market by Hardware, and Industry Vertical: Global Opportunity Analysis and Industry Forecast, 2023-2032," the IOT chips market was valued at $432.01 billion in 2022 and is estimated to reach $1.7 trillion by 2032, growing at a CAGR of 14.3% from 2023 to 2032.

An Internet of Things (IOT) chip is a small electronic device equipped with sensors, processors, and communication modules that enable it to interact with other devices and systems via the internet. These chips collect data from their surroundings, process it, and transmit it to a central server or other connected devices. They play a crucial role in enabling the functionality of IoT devices by facilitating communication, data processing, and control. IoT chips are integral to various applications, including smart home devices, industrial automation, healthcare monitoring, and environmental sensing, driving the advancement of the IoT ecosystem.

The increase in adoption of IoT devices across various sectors is driven by their ability to enhance efficiency, automate processes, and provide valuable insights through data collection and analysis this increases the IoT chips market demand. In sectors such as healthcare, IoT devices enable remote patient monitoring, medication adherence tracking, and predictive maintenance of medical equipment, leading to improved patient outcomes and cost savings. Similarly, in agriculture, IoT sensors monitor soil moisture levels, weather conditions, and crop health, optimizing irrigation and fertilizer usage to increase yields and reduce resource waste. The widespread adoption of IoT devices underscores the rise in need for IoT chips to power these devices and support their connectivity, data processing, and control functions.

However, cost constraints serve as a significant restraint for the IOT chips industry, manifested through substantial initial investments and high development costs associated with advanced technologies. The development and implementation of IOT chip technology involve high costs, limiting its adoption, particularly among smaller organizations and startups.

Moreover, the expansion of smart infrastructure projects presents significant opportunities for IoT chip manufacturers to supply components for these initiatives. Smart cities, for example, deploy IoT sensors and devices for traffic management, waste management, energy efficiency, and public safety, creating a demand for specialized IoT chips optimized for these applications. Similarly, smart grids leverage IoT technology to monitor and manage energy distribution, reduce outages, and integrate renewable energy sources. With governments and businesses investing in the development of smarter and more sustainable infrastructure, manufacturers of IoT chips have the chance to collaborate with infrastructure providers and solution integrators to furnish the necessary components for these projects, thereby driving market growth and innovation.

The IoT chips market segmentation is segmented based on the basis of hardware, industry vertical, and region. On the basis of hardware, the market is divided into processor, sensor, connectivity IC, memory device, logic device, and others. On the basis of industry vertical, the IoT chips market growth projections is classified into healthcare, consumer electronics, industrial, automotive, BFSI, retail, and others.

On the basis of region, the IoT chips market analysis is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, Australia, and rest of Asia-Pacific), Latin America (Brazil, Argentina, and rest of Latin America), and Middle East and Africa (UAE, Saudi Arabia, Qatar, South Africa, and rest of Middle East & Africa).

The key players profiled in the IoT chips industry include Qualcomm Technologies Inc., STMicroelectronics NV, Samsung Electronics Co. Ltd, Analog Devices Inc., Intel Corporation, Texas Instruments Incorporated, NXP Semiconductors NV, Infineon Technologies AG, MediaTek Inc., and Microchip Technology Inc. These key players have adopted strategies such as product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations to enhance their IoT AI chips market penetration.

Key Findings of the Study

The 5G IOT chipset adoption is expected to grow significantly in the coming years, driven by the rise in demand for automated operations by various industries.

The demand for IOT chips in the consumer electronics sector is expected to drive the market.

The IoT chips market share is highly competitive, with several major players competing for market share. The competition is expected to intensify in the coming years as new players enter the market.

The Asia-Pacific region is expected to be a major IOT chips market size owing to significant government investments, a strong focus on domestic technology development, and established players such as Samsung Electronics Co. Ltd and MediaTek Inc in the region.

#iot#iotsolutions#technology#ai generated#iot platform#iotmanagement#iot applications#automation#techinnovation#technologynews#smartcities#techtrends

0 notes

Text

Global PCD Tool Five-Axis Laser Processing Market: Technological Change Drives the Reconstruction of Tens of Billions of Tracks

Keywords:PCD tool machining, 5-axis laser equipment, superhard tool market, laser precision manufacturing, automotive tool upgrade

First, the market size and growth momentum

The global PCD tool market is expected to exceed $4.8 billion in 2025 (Grand View Research data), of which the penetration rate of five-axis laser processing equipment has jumped from 17% in 2020 to 39%, becoming the fastest growing segment. Core drivers include:

The outbreak of new energy vehicles: the demand for power battery shell processing has surged, and the life of PCD tools has been increased by 8-12 times compared with cemented carbide

3C electronic miniaturization: The tool diameter of the iPhone 17 series lens module has been reduced to φ0.08mm, and the traditional processing method is invalid

Policy forced upgrade: China's "14th Five-Year Plan" high-end equipment plan includes laser five-axis systems in the key research catalog

Cost structure optimization: The processing cost of 5-axis laser equipment per hour is 42% lower than that of EDM (measured by Sandvik Coromant).

2. Analysis of technological competitiveness

Five-axis laser processing is subverting the traditional process pattern and forming three major technical moats:

1. Precision Revolution

Edge collapse control: Laser pulse modulation technology < 2 μm for edge collapse, while the grinding process is generally > 5 μm

Geometric tolerance: 5-axis linkage to achieve 0.005mm/m straightness compensation

2. Efficiency Leap

Integration of roughing and finishing: 12 processes are completed in a single clamping, saving 78% of auxiliary time

Material removal rate: 15mm³/min laser ablation speed is 5 times faster than wire cutting

Unmanned production: The model with integrated machine vision can run continuously for 1,200 hours

3. Material Compatibility

Composite structure: Laser selective melting realizes the gradient combination of the diamond layer and the cemented carbide matrix

Micro-control: Femtosecond laser fabricates microtextures with a depth of < 50 nm on the surface of PCD

3. Regional competition pattern

Technology Leader Echelon (62% Market Share)

GERMANY: THE TRUMPF + SCHLEIFRING CONSORTIUM DOMINATES THE AUTOMOTIVE TOOL MARKET

Japan: MAZAK maintains a monopoly on 0.1μm-level accuracy in the field of 3C micro tools

Switzerland: GF processing plan(GF Machining Solutions)Focus on aerospace special cutting tools

China: TKD CO., LTD focuses on laser cutting, laser grinding of woodworking tools and metalworking tool materials

2. Clusters of emerging catch-ups (28% y/y)

China: Han's Laser, Huagong Technology and other companies have pushed the unit price of equipment to $450,000 through modular design

South Korea: Doosan Machine Tools relies on Samsung's supply chain to seize the semiconductor tool processing market

4. Trend forecast for the next three years

Intelligent penetration: By 2027, 70% of equipment will be equipped with AI process optimization system (AMR prediction).

Green manufacturing: The utilization rate of laser energy will be increased from the current 35% to 60%, and carbon emissions will be reduced by 46%.

Service model innovation: the proportion of charging according to the number of processed pieces (CPP model) will exceed the sales of traditional equipment

Conclusion: Under the superposition effect of the blowout demand for Tesla's 4680 battery tools and the processing of Apple's Vision Pro optical components, the five-axis laser processing equipment is changing from "optional equipment" to "strategic rigid demand". Enterprises need to complete the technology card position by 2026 to seize this wave of incremental dividends of 23% per year.

#technology#pcd laser#five axis pcd laser grinding machine#PCD tool machining#5-axis laser equipment#superhard tool market#laser precision manufacturing#automotive tool upgrade

0 notes

Text

Photonic Integrated Circuit Market: Key Players and Competitive Landscape

The global photonic integrated circuit market size is expected to reach USD 25.80 billion by 2030, registering a CAGR of 10.8% from 2025 to 2030, according to a new report by Grand View Research, Inc. Photonic IC is an integrated circuit that uses optical wavelength as an information signal and provides multiple integrated photonic functions. Photonic IC, as such, is similar to an electronic IC and can be a viable replacement for it as well as for the copper-based wired transmission. Photonic IC forms an integral part of lasers, optical amplifiers, modulators, and MUX/DEMUX components, which are extensively used in the optical signal processing, optical communication, biophotonics, and sensing applications. The growing demand for sensing and optical devices are expected to fuel the growth of the photonic IC market.

There is an increasing need for cost effective, power efficient, and compact PICs which would further propel the photonic IC market over the forecast period across the mobile broadband Internet access, high-performance computing, datacenter, and enterprise networking, along with metro and long haul data communications, among many others. The increasing adoption of the high-level integrated PICs and application-specific PICs would boost the photonic IC market to strive for greater functionality and new product development across a number of verticals.

The photonic IC market is anticipated to grow substantially due to the continuous technological advancements and the evolving end-user demands. The laser, optical amplifier, and MUX/DEMUX component segments possess enormous growing opportunities, owing to the ability of photonic ICs to incorporate new optical functionalities that can be embedded on a single chip to achieve high efficiency and compactness.

The increasing demand for the optical communication and sensing applications is driving the growth of photonic ICs around the globe with an efficient management of datacenters and long haul networks providing a thriving market for them. Moreover, with the advancements in quantum computing, the adoption of photonic ICs are increasing as they allow multitasking that quantum computing readily requires. Also, the growing adoption of the biophotonic application in medical devices also holds considerable growth opportunities for the photonic ICs market. On the other hand, the high bandwidth and optimum performance requirements of the telecommunication industry, data storage, cloud service providers, and large business enterprises are expected to boost the optical communication and signal processing segments. This market will create many new opportunities culminating in an increased adoption of photonic ICs over the forecasted period.

Request Free Sample PDF of Photonic Integrated Circuit Market Size, Share & Trends Analysis Report

Photonic Integrated Circuit Market Report Highlights

• Based on materials, the III-V Material segment dominated the global photonic integrated circuit market industry with a revenue share of 33.2% in 2024.

• Based on integration process, the hybrid integration segment dominated the global market for photonic integrated circuits in 2024. Some of the common techniques for hybrid integration include selective area growth, die-to-wafer bonding, flip-chip bonding, and others.

• Based on application, the data centers segment accounted for the largest revenue share of the global market in 2024. This is attributed to the performance improvement capacities of photonic integrated circuits (PICs).

• North America photonic integrated circuit market held the largest revenue share of 38.5% in 2024. This is attributed to factors such as growing 5G networks in the region, the large number of data centers operating in North America, the growing demand for the biomedical sector, and the presence of multiple semiconductor market participants in the region.

Photonic Integrated Circuit Market Segmentation

Grand View Research has segmented the global photonic integrated circuit market on the basis of on material, integration process, application, and region:

Photonic Integrated Circuit Material Outlook (Revenue, USD Billion, 2018 - 2030)

• III-V Material

• Lithium Niobate

• Silica-on-silicon

• Others

Photonic Integrated Circuit Integration Process Outlook (Revenue, USD Billion, 2018 - 2030)

• Hybrid

• Monolithic

Photonic Integrated Circuit Application Outlook (Revenue, USD Billion, 2018 - 2030)

• Telecommunications

• Biomedical

• Data Centers

• Others

Photonic Integrated Circuit Regional Outlook (Revenue, USD Billion, 2018 - 2030)

• North America

o U.S.

o Canada

o Mexico

• Europe

o Germany

o UK

o France

• Asia Pacific

o China

o Japan

o India

o South Korea

o Australia

• Latin America

o Brazil

• Middle East and Africa (MEA)

o Saudi Arabia

o UAE

o South Africa

List of Key Players in the Photonic Integrated Circuit Market

• Lumentum Operations LLC

• POET Technologies

• Coherent Corp.

• Infinera Corporation

• Intel Corporation

• Cisco Systems Inc.

• Source Photonics.

• Caliopa (Huawei Technologies Co. Ltd)

• EFFECT PHOTONICS

• ANSYS, Inc

Order a free sample PDF of the Photonic Integrated Circuit Market Intelligence Study, published by Grand View Research.

#Photonic Integrated Circuit Market#Photonic Integrated Circuit Market Analysis#Photonic Integrated Circuit Market Report#Photonic Integrated Circuit Market Size#Photonic Integrated Circuit Market Share

0 notes

Text

Silicon Carbide for EV Market Analysis and Key Developments to 2033

Introduction

The electric vehicle (EV) market is experiencing unprecedented growth, driven by technological advancements, regulatory policies, and increasing consumer demand for sustainable transportation. One of the critical enablers of this growth is the advancement of power electronics, where silicon carbide (SiC) is emerging as a game-changing material. Silicon carbide, a wide-bandgap semiconductor, offers superior performance compared to traditional silicon-based components, particularly in power conversion, efficiency, and thermal management.

What is Silicon Carbide (SiC)?

Silicon carbide is a compound of silicon and carbon, known for its exceptional hardness, thermal conductivity, and high power handling capabilities. SiC semiconductors are used in a variety of power electronic applications, including inverters, chargers, and power modules for EVs. The material's ability to operate at higher voltages, temperatures, and frequencies makes it ideal for enhancing the efficiency and performance of electric vehicles.

Download a Free Sample Report:-https://tinyurl.com/3rcx8jdb

Why SiC in Electric Vehicles?

Improved Efficiency: SiC components can reduce power losses by up to 50% compared to traditional silicon, leading to enhanced efficiency in EV powertrains.

Extended Range: Higher efficiency in inverters and power electronics contributes to longer EV ranges, a critical factor in consumer adoption.

Faster Charging: SiC technology enables higher power levels in onboard chargers, reducing charging times significantly.

Compact and Lightweight: The use of SiC reduces the size and weight of power modules, allowing for more design flexibility and space savings in EVs.

Thermal Management: SiC devices can handle higher temperatures, reducing the need for complex cooling systems.

Market Trends

1. Growing EV Adoption

The global push for electrification, driven by regulatory mandates and consumer demand, is fueling the adoption of SiC in EVs. Governments worldwide are setting ambitious targets to phase out internal combustion engines, which is propelling the demand for advanced power electronics.

2. Advancements in Charging Infrastructure

Fast-charging networks are expanding rapidly, necessitating power devices capable of handling high voltage and current. SiC's efficiency in high-power applications makes it the material of choice for fast chargers.

3. Partnerships and Collaborations

Major automakers and semiconductor companies are entering into strategic partnerships to develop SiC-based solutions. For example, Tesla’s use of SiC MOSFETs in its Model 3 inverter has set a benchmark for the industry.

4. Cost Reduction Strategies

While SiC components are currently more expensive than silicon, advancements in manufacturing processes and economies of scale are expected to reduce costs, enhancing market penetration.

Market Forecast to 2032

The silicon carbide market for electric vehicles is projected to witness a compound annual growth rate (CAGR) of over 25% from 2023 to 2032. By 2032, the market size could exceed several billion dollars, driven by the growing adoption of EVs, advancements in SiC technology, and increasing investments in EV infrastructure.

Regional Insights

North America: High adoption rate of EVs and government incentives are driving SiC market growth.

Europe: Stringent emission regulations and a strong EV manufacturing base support market expansion.

Asia-Pacific: Rapid industrialization and the presence of leading EV manufacturers like BYD and NIO make this region highly lucrative.

Key Players in the SiC Market

Leading companies in the silicon carbide market include:

Wolfspeed, Inc.

Infineon Technologies AG

ON Semiconductor

STMicroelectronics

ROHM Semiconductor

These companies are focusing on R&D, mergers, and acquisitions to strengthen their market position and enhance their product portfolios.

Challenges

Despite its benefits, the adoption of SiC faces several challenges, including:

High Manufacturing Costs: SiC wafers are more expensive to produce than traditional silicon.

Supply Chain Issues: Limited availability of raw materials can affect production.

Technical Barriers: Integration of SiC components requires significant redesign of power systems.

Conclusion

Silicon carbide is poised to play a critical role in the future of electric vehicles. As the EV market continues to grow, the demand for high-efficiency power electronics will drive SiC adoption. While challenges remain, ongoing research and development, along with industry collaboration, are likely to overcome these hurdles. By 2032, silicon carbide could become a standard material in EV powertrains, contributing significantly to the broader goal of sustainable and efficient transportation.Read Full Report:-https://www.uniprismmarketresearch.com/verticals/automotive-transportation/silicon-carbide-for-ev.html

0 notes

Text

Silicon Carbide Wafer Market Analysis, Size, Share, Growth, Trends, and Forecasts by 2031

The Global Silicon Carbide Wafer Market stands as a testament of semiconductor technology, where precision and efficiency play pivotal roles. Silicon carbide (SiC) wafers, integral components in this market, have garnered attention for their exceptional properties that propel technological advancements in various sectors.

𝐆𝐞𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭:https://www.metastatinsight.com/request-sample/2302

Companies

Cree

SK siltron Co.,Ltd.

SiCrystal

II-VI Advanced Materials

Showa Denko K.K.

STMicroelectronics

Aymont Technology

TankeBlue

Hebei Synlight Crystal

CETC

T𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭:@https://www.metastatinsight.com/report/silicon-carbide-wafer-market

Silicon carbide, a compound of silicon and carbon, presents a unique blend of characteristics that make it an ideal material for semiconductor applications. The Global Silicon Carbide Wafer Market revolves around the production and utilization of these wafers, showcasing their significance in cutting-edge technological developments.

One of the key drivers behind the demand for silicon carbide wafers is their ability to operate at higher temperatures and withstand extreme conditions. This resilience is particularly crucial in industries such as power electronics, where SiC wafers enable the creation of devices capable of handling elevated temperatures and harsh environments. As the world witnesses a growing reliance on electronic devices in various sectors, the demand for silicon carbide wafers in power electronics continues to surge.

Moreover, the Global Silicon Carbide Wafer Market plays a vital role in the realm of renewable energy. SiC wafers contribute to the development of efficient power devices, facilitating the conversion and management of energy in renewable sources like solar and wind. The unique electronic properties of silicon carbide make it an essential material in enhancing the overall efficiency and performance of power systems in the renewable energy sector.

In the automotive industry, silicon carbide wafers find applications in electric vehicles (EVs) as power electronics components. The high-temperature tolerance and superior electrical conductivity of SiC wafers contribute to the development of compact and efficient power modules, enhancing the performance of EVs and supporting the global shift towards sustainable transportation.

Furthermore, the Global Silicon Carbide Wafer Market extends its influence into the realm of communication technologies. The deployment of SiC wafers in high-frequency and high-power devices for radio frequency (RF) applications is on the rise. The ability of silicon carbide to handle high-power levels with minimal losses makes it an attractive choice for RF components, paving the way for advancements in wireless communication systems.

The Global Silicon Carbide Wafer Market is not merely a segment of the semiconductor industry; it is a catalyst for innovation and progress across diverse sectors. Silicon carbide wafers, with their unique properties, contribute significantly to the development of advanced technologies that shape the future of power electronics, renewable energy, automotive systems, and communication networks. As industries continue to evolve, the demand for silicon carbide wafers is set to rise, propelling the market forward as a key player in the transformative journey of modern technology.

Global Silicon Carbide Wafer market is estimated to reach $1,290.0 Million by 2030; growing at a CAGR of 11.2% from 2023 to 2030.

Contact Us:

+1 214 613 5758

#SiliconCarbideWafer#SiliconCarbideWafermarket#SiliconCarbideWaferindustry#marketsize#marketgrowth#marketforecast#marketanalysis#marketdemand#marketreport#marketresearch

0 notes

Text

Silicon Carbide Wafer Market Analysis, Size, Share, Growth, Trends, and Forecasts by 2031

The Global Silicon Carbide Wafer Market stands as a testament of semiconductor technology, where precision and efficiency play pivotal roles. Silicon carbide (SiC) wafers, integral components in this market, have garnered attention for their exceptional properties that propel technological advancements in various sectors.

𝐆𝐞𝐭 𝐚 𝐅𝐫𝐞𝐞 𝐒𝐚𝐦𝐩𝐥𝐞 𝐑𝐞𝐩𝐨𝐫𝐭:https://www.metastatinsight.com/request-sample/2302

Top Companies

Cree

SK siltron Co.,Ltd.

SiCrystal

II-VI Advanced Materials

Showa Denko K.K.

STMicroelectronics

Aymont Technology

TankeBlue

Hebei Synlight Crystal

CETC

𝐄𝐱𝐩𝐥𝐨𝐫𝐞 𝐭𝐡𝐞 𝐅𝐮𝐥𝐥 𝐑𝐞𝐩𝐨𝐫𝐭:@https://www.metastatinsight.com/report/silicon-carbide-wafer-market

Silicon carbide, a compound of silicon and carbon, presents a unique blend of characteristics that make it an ideal material for semiconductor applications. The Global Silicon Carbide Wafer Market revolves around the production and utilization of these wafers, showcasing their significance in cutting-edge technological developments.

In the automotive industry, silicon carbide wafers find applications in electric vehicles (EVs) as power electronics components. The high-temperature tolerance and superior electrical conductivity of SiC wafers contribute to the development of compact and efficient power modules, enhancing the performance of EVs and supporting the global shift towards sustainable transportation.

Furthermore, the Global Silicon Carbide Wafer Market extends its influence into the realm of communication technologies. The deployment of SiC wafers in high-frequency and high-power devices for radio frequency (RF) applications is on the rise. The ability of silicon carbide to handle high-power levels with minimal losses makes it an attractive choice for RF components, paving the way for advancements in wireless communication systems.

The Global Silicon Carbide Wafer Market is not merely a segment of the semiconductor industry; it is a catalyst for innovation and progress across diverse sectors. Silicon carbide wafers, with their unique properties, contribute significantly to the development of advanced technologies that shape the future of power electronics, renewable energy, automotive systems, and communication networks. As industries continue to evolve, the demand for silicon carbide wafers is set to rise, propelling the market forward as a key player in the transformative journey of modern technology.

Global Silicon Carbide Wafer market is estimated to reach $1,290.0 Million by 2030; growing at a CAGR of 11.2% from 2023 to 2030.

Contact Us:

+1 214 613 5758

#SiliconCarbideWafer#SiliconCarbideWafermarket#SiliconCarbideWaferindustry#marketsize#marketgrowth#marketforecast#marketanalysis#marketdemand#marketreport#marketresearch

0 notes

Text

Computer Aided Engineering Market 2024 : Size, Growth Rate, Business Module, Product Scope, Regional Analysis And Expansions 2033

The computer aided engineering global market report 2024 from The Business Research Company provides comprehensive market statistics, including global market size, regional shares, competitor market share, detailed segments, trends, and opportunities. This report offers an in-depth analysis of current and future industry scenarios, delivering a complete perspective for thriving in the industrial automation software market.

Computer Aided Engineering Market, 2024 report by The Business Research Company offers comprehensive insights into the current state of the market and highlights future growth opportunities.

Market Size - The computer aided engineering market size has grown strongly in recent years. It will grow from $8.97 billion in 2023 to $9.87 billion in 2024 at a compound annual growth rate (CAGR) of 10.0%.The growth in the historic period can be attributed to advancements in computational power, globalization of engineering work, increasing complexity in product design, simulation-driven design, cost and time savings, regulatory compliance requirements, automotive crash testing simulation.

The computer aided engineering market size is expected to see strong growth in the next few years. It will grow to $14.1 billion in 2028 at a compound annual growth rate (CAGR) of 9.3%.The growth in the forecast period can be attributed to rise of industry 4.0 and smart manufacturing, increased complexity in electronics design, focus on sustainability and environmental impact, enhanced human-machine interaction simulations, digitalization of construction and infrastructure, increased use in consumer electronics. Major trends in the forecast period include increased integration of multiphysics simulations, advancements in high-performance computing (hpc), growing adoption of cloud-based cae, focus on user-friendly interfaces and workflows, increased use of generative design, use of virtual prototyping for system-level simulation.

Order your report now for swift delivery @ https://www.thebusinessresearchcompany.com/report/computer-aided-engineering-global-market-report

The Business Research Company's reports encompass a wide range of information, including:

1. Market Size (Historic and Forecast): Analysis of the market's historical performance and projections for future growth.

2. Drivers: Examination of the key factors propelling market growth.

3. Trends: Identification of emerging trends and patterns shaping the market landscape.

4. Key Segments: Breakdown of the market into its primary segments and their respective performance.

5. Focus Regions and Geographies: Insight into the most critical regions and geographical areas influencing the market.

6. Macro Economic Factors: Assessment of broader economic elements impacting the market.

Market Drivers - Increasing automation in the manufacturing sector is expected to propel the growth of the computer-aided engineering market going forward. Automation refers to the development and deployment of technologies for the production and delivery of products and services with little or no human participation. Automation technologies such as computer-aided drafting and computer-assisted N/C tape preparation are now available and widely used in the manufacturing sector to help reverse the troubling trend of declining productivity. For instance, in September 2023, according to the International Federation of Robotics (IFR), a Germany-based professional non-profit organization, the total number of service robots sold for professional use hit 158,000 units in 2022—an increase of 48%. It is recorded that 553,052 industrial robot installations are in factories around the world—a growth rate of 5% in 2022, year-on-year. Therefore, increasing automation in the manufacturing sector is expected to drive the growth of the computer-aided engineering market.

Market Trends - Technological advancements are the key trend gaining popularity in the computer-aided engineering market. Major companies operating in computer-aided engineering are focused on developing new technological solutions to attain a competitive edge in the market. For instance, in June 2021, Siemens AG, a German-based industrial manufacturing company, launched Simcenter Femap, a sophisticated simulation application that allows users to create, update, and evaluate finite element models of complicated goods or systems. Simcenter Femap offers sophisticated data-driven and graphical result visualization and assessment when paired with the industry-leading Simcenter Nastran, resulting in a full computer-aided engineering solution that optimizes the product's performance. When paired with the industry-leading Simcenter Nastran, Simcenter Femap offers sophisticated data-driven and graphical results display and evaluation, resulting in a full CAE solution that enhances product performance.

The computer aided engineering market covered in this report is segmented ��

1) By Type: Finite Element Analysis (FEA), Computational Fluid Dynamics (CFD), Multibody Dynamics, Optimization and Simulation 2) By Depolyment: On-Premise, Cloud-Based 3) By End-Use: Automotive, Defense and Aerospace, Electronics, Medical Devices, Industrial Equipment

Get an inside scoop of the computer aided engineering market, Request now for Sample Report @ https://www.thebusinessresearchcompany.com/sample.aspx?id=7941&type=smp

Regional Insights - Europe was the largest region in the computer-aided engineering market in 2023. The regions covered in the computer aided engineering market report are Asia-Pacific, Western Europe, Eastern Europe, North America, South America, Middle East, Africa.

Key Companies - Major companies operating in the computer aided engineering market report are Altair Engineering Inc., Dassault Systèmes SE, ESI Group, Siemens AG, Hexagon AB, Seiko Epson Corporation, Exa Corporation, Bentley Systems Inc., Numeca International, Dell Inc., Aspen Technology Inc., Symscape Pty Ltd, Synopsys Inc., Aveva Group plc, Autodesk Inc., ANSYS Inc., PTC Inc., COMSOL Inc., MSC Software Corporation, Mentor Graphics Corporation, The MathWorks Inc., OpenText Corporation, Siemens Industry Software NV, CD-adapco, ETA Engineering Inc., Ricardo Software, ZWSOFT Co. Ltd., Zemax LLC, Flow Science Inc., GNS Systems GmbH, AVL List GmbH, EnginSoft S.p.A.

Table of Contents 1. Executive Summary 2. Computer Aided Engineering Market Report Structure 3. Computer Aided Engineering Market Trends And Strategies 4. Computer Aided Engineering Market – Macro Economic Scenario 5. Computer Aided Engineering Market Size And Growth ….. 27. Computer Aided Engineering Market Competitor Landscape And Company Profiles 28. Key Mergers And Acquisitions 29. Future Outlook and Potential Analysis 30. Appendix

Contact Us:

The Business Research Company

Europe: +44 207 1930 708

Asia: +91 88972 63534

Americas: +1 315 623 0293

Email: [email protected]

Follow Us On:

LinkedIn: https://in.linkedin.com/company/the-business-research-company

Twitter: https://twitter.com/tbrc_info

Facebook: https://www.facebook.com/TheBusinessResearchCompany

YouTube: https://www.youtube.com/channel/UC24_fI0rV8cR5DxlCpgmyFQ

Blog: https://blog.tbrc.info/

Healthcare Blog: https://healthcareresearchreports.com/

Global Market Model: https://www.thebusinessresearchcompany.com/global-market-model

0 notes

Text

Science and technology in Japan has helped fuel the rapid industrial and economic development of the country. Japan has a long history and tradition for scientific research and development, stretching as far back as the Meiji period.

However, science and technology developed rapidly after the Second World War, which has affected the advancement of vehicle technology, consumer electronics, robotics, medical devices, space exploration, and the film industry. Japan's exemplary educational system as well its higher education institutions help contribute to the country's acceptance for technological innovation and aid engineering talent development.

High levels of support for research and development have enabled Japan to produce advances in automotive engines, television display technology, videogames, optical clocks, and many other fields. Japan is also advanced and a global leader in the robotics, natural sciences, aerospace exploration and biomedical research areas. In 2023, Japan was ranked 13th in the Global Innovation Index by the World Intellectual Property Organization.[1]

Scientific research in Japan is supported and promoted by the Japanese Government through various institutes and agencies including the Japan Science and Technology Agency (科学技術振興機構), Science Council of Japan (日本学術会議) and the Japan Academy (日本学士院).

Aerospace research

Founded in 2003 through the merging of three aerospace organisations (Institute of Space and Astronautical Science, National Aerospace Laboratory, and the National Space Development Agency of Japan), the Japan Aerospace Exploration Agency (JAXA) conducts space and planetary exploration, aviation research, and the development of various space technologies and satellites. JAXA has developed a series of rockets in conjunction with Japanese heavy manufacturers such as Mitsubishi Heavy Industries. The organisation was also responsible for the development of the Japanese Experiment Module (also known as KIBO), which was launched and added to the International Space Station during Space Shuttle assembly flights in 2007 and 2008 and the HTV to transfer payloads to the station in 2009.

Japan also sends several astronauts to work in the ISS and help other international collaborators with space research and technology transfers. Since 1990, twelve Japanese individuals have participated in space flights, two of whom were women. Two Japanese astronauts also served as commanders of the ISS, with the last being Akihiko Hoshide.

In recent years, Japan's Hayabusa2 spacecraft has been used to collect samples from a near-Earth asteroid called Ryugu and back to Earth for research and analysis. The 6-year mission ended in 2020.

Nuclear energy

Main article: Nuclear power in JapanThe Onagawa Nuclear Power Plant, a 3-unit BWR site typical of Japan's nuclear plants

Since 1973, Japan has been looking to become less dependent on imported fuel and start to depend on nuclear energy. In 2008, after the opening of 7 brand new nuclear reactors in Japan (3 on Honshū, and 1 each on Hokkaidō, Kyūshū, Shikoku, and Tanegashima) Japan became the third largest nuclear power user in the world with 55 nuclear reactors. These provide 34.5% of Japan's electricity.

Following an earthquake, tsunami, and the failure of cooling systems at the Fukushima I Nuclear Power Plant on March 11, 2011, a nuclear emergency was declared. 140,000 residents within 20 km of the plant were evacuated. See Radiation effects from Fukushima Daiichi nuclear disaster 900.

Electronics

Japan is well known for its electronics industry throughout the world, and Japanese electronic products account for a large share in the world market, compared to a majority of other countries. Japan is one of the leading nations in the fields of scientific research, technology, machinery, and medical research with the world's third largest budget for research and development at $130 billion USD, and over 677,731 researchers. Japan has received the most science Nobel prizes in Asia

Japan has large international corporate conglomerates such as Fuji (which developed the nation's first electronic computer, FUJIC1999, in 1956) and Sony. Sony, Panasonic, Canon, Fujitsu, Hitachi, Sharp, NEC, Nintendo, Epson and Toshiba are among the best-known electronics companies in the world. Toyota, Honda, Nissan, Mazda, Mitsubishi, Suzuki, and Subaru are also very well known automobile companies in the world.

It is estimated that compared to the amount of known reserves still in the ground, 16% of the world's gold and 22% of silver is contained in electronic technology in Japan.

Robotics

Japan is also known for robotics. There are many types of robots that are used in restaurants, hospitals, parks, or in different companies.[6] Robots are used for different purposes, such as in restaurants in Japan. Japanese research companies are researching on advanced AI robots that can mimic the work of humans.[7]

Medicine and healthcare

Japan is also a global leader in the area of biomedical research along with the United States and elsewhere. In 2015, the country established the Japan Agency for Medical Research and Development to help implement biomedical research and development projects and improve the support infrastructure for clinical research. Medical research in Japan typically takes place in various national university and private university research hospitals. These research hospitals include University of Tokyo Hospital, Tohoku University Hospital, and Keio University Hospital among others.

0 notes

Text

Enphase IQ 7A Microinverter Review

With over 30 million microinverters shipped to date, Enphase is a leader in solar power technology. They offer a range of products including communication gateways, installer toolkits and monitoring systems.

The IQ Battery 5P has a 15-year warranty, which is longer than most other batteries on the market. It also uses Lithium Ferro Phosphate chemistry, which offers superior longevity.

Easy to install

The smart-grid ready enphase iq 7a microinverter is built on the seventh-generation enphase IQ platform and achieves the highest efficiencies for module-level power electronics. Its polymer enclosure and revolutionary cabling system simplify installation.

The IQ 7A is rock-solid reliable, proven through a million hours of reliability testing. Its all-AC design and integrated rapid shutdown shut down energy production in the event of grid failure, or for safety reasons during home electrical work or a storm.

Ensure all DC cable connections are properly terminated using the IQ Disconnect Tool. Install sealing caps on unused connectors on the AC cables, as they become live when the system is energized. Always dress excess cabling in loops to avoid contacting the roof surface, and keep a copy of the installation map for your records. Be sure to size the AC wire gauge based on the distance from the load center to your breaker in the branch circuit. Leaving any AC cable uncovered may cause voltage rise and impact the performance of your system.

Easy to monitor

The seventh-generation IQ platform is ready for smart grids and offers the highest efficiency among existing module-level power electronics solutions. Its polymer housing and revolutionary cabling system simplify installation.

Ensure the microinverters are connected to AC power with a 20 A maximum breaker or fuse. Observe the safety and cautionary markings on this equipment and in the manual.

Use a clamp-on meter to verify that no current is flowing through the DC wires between the PV modules and the microinverter. If current is flowing, check for a loose or damaged PV module connection or bonding hardware.

Ensure that any unused AC connectors are covered with Enphase sealant. Loose connections can be a tripping hazard. Provide support every 1.8m (6 feet) with the Enphase Q Cable, and dress them carefully to minimize tripping.

Low maintenance

Enphase IQ microinverters are built to last with an industry-leading 25 year warranty. They also have fewer parts and undergo over a million hours of power-on testing. This makes them extremely reliable, even with high solar panel production.

The IQ system eliminates numerous electrical balance of system components and features plug-and-play connectors that connect to your PV modules. This allows installers to customize the layout of the system with more flexibility and less labor. It also reduces the total cost of ownership.

IQ Series Microinverters are smart grid-ready and integrate seamlessly with the Enphase IQ Envoy, Enphase Q Aggregator, Enphase IQ Battery, and Enlighten monitoring and analysis software. It is also storage-ready so that you can add an Enphase AC Battery now or down the road.

Enphase microinverters are designed to be easily monitored by the IQ Envoy, or remotely from any internet-connected device. If you notice that a particular module isn’t producing as much energy, try swapping the DC lead with an adjacent one.

Long-term reliability

Microinverters are designed with rock-solid quality solar. They undergo extensive quality and reliability testing in order to qualify for Enphase’s industry-leading 15year product warranty that can be extended to 25 years.

Infant mortality failures are caused by a product’s initial deployment in the field. These failures typically occur within the first few weeks of a new installation and relate to a specific phase in the manufacturing process. Enphase continually analyzes these field failures and applies corrective action to its already tightly controlled manufacturing process, thus reducing infant mortality over time.

The IQ 8 series offers increased power density for systems with more panels or battery capacity and features grid-forming capabilities to support back-up operations during a blackout. It also carries on the all-AC design of previous IQ microinverters, which nearly eliminates the risk of exposing installers, homeowners, or first responders to high-voltage DC electricity. The IQ 8 also features rapid shutdown functionality, which shuts down energy production quickly and safely in the event of a blackout.

0 notes

Text

RF (Radio Frequency)Testing: Ensuring Quality and Reliability

In today's interconnected world, radio frequency (RF) technology is ubiquitous, playing a critical role in everything from mobile communications and broadcasting to radar and satellite navigation. As such, ensuring the quality and reliability of RF components and systems is paramount.

RF testing, a specialized field of electronic testing, is essential in verifying that these devices meet stringent performance and safety standards. This blog explores the importance of RF testing, its key methods, and its applications across various industries.

Understanding RF Testing

RF testing involves evaluating the performance, compliance, and safety of devices that operate using radio frequencies. This encompasses a broad spectrum of products, including smartphones, Wi-Fi routers, Bluetooth devices, and even complex aerospace and defense systems.

The primary goal of RF testing is to ensure that these devices operate correctly within their designated frequency bands without causing interference or exceeding regulatory limits.

Importance of RF Testing

1. Compliance with Regulations

Regulatory bodies such as the Federal Communications Commission (FCC) in the United States, the European Telecommunications Standards Institute (ETSI) in Europe, and the Telecommunications Engineering Center (TEC) in India have established stringent guidelines for RF devices.

Compliance with these regulations is mandatory for legal market entry. RF testing ensures that products meet these regulatory requirements, thereby avoiding legal and financial penalties.

2. Performance Verification

RF testing assesses key performance metrics such as signal strength, frequency accuracy, and modulation quality. Ensuring optimal performance is critical for maintaining the reliability and functionality of RF devices, especially in mission-critical applications such as emergency communications and military operations.

3. Interference Mitigation

RF interference can severely degrade the performance of wireless devices, leading to dropped calls, poor signal quality, and disrupted communications.

Through RF testing, manufacturers can identify and mitigate potential interference issues, ensuring seamless and reliable operation of their products.

4. Safety Assurance

Exposure to high levels of RF radiation can pose health risks. RF testing measures the electromagnetic emissions of devices to ensure they fall within safe limits, protecting users and complying with health and safety standards.

Key Methods of RF Testing

RF testing employs a variety of methods to evaluate different aspects of a device's performance and compliance. Here are some of the most common techniques:

1. Spectrum Analysis

Spectrum analysis is fundamental in RF testing. It involves measuring the frequency spectrum of a signal to determine its characteristics, such as bandwidth, frequency stability, and signal purity.

A spectrum analyzer is used to visualize the signal and identify any spurious emissions or harmonics that may cause interference.

2. Network Analysis

Network analysis evaluates the impedance, reflection, and transmission characteristics of RF circuits and components.

Vector network analyzers (VNAs) are commonly used to measure parameters such as S-parameters, which describe how RF signals behave when they encounter different circuit elements.

This is crucial for ensuring impedance matching and minimizing signal loss.

3. Power Measurement

Accurate power measurement is vital for verifying that RF devices operate within their specified power limits.

Power meters and sensors are used to measure both continuous wave (CW) and modulated RF signals. This helps in assessing the output power, efficiency, and linearity of RF amplifiers and transmitters.

4. Modulation Analysis

Modulation analysis involves examining the modulation quality of RF signals. It assesses parameters such as error vector magnitude (EVM), bit error rate (BER), and adjacent channel power ratio (ACPR).

This is particularly important for digital communication systems, where modulation integrity directly impacts data transmission quality.

5. Electromagnetic Compatibility (EMC) Testing

EMC testing ensures that RF devices do not emit excessive electromagnetic interference (EMI) and are immune to external electromagnetic disturbances.

This involves both radiated and conducted emissions testing, as well as susceptibility testing, to verify that the device operates reliably in its intended electromagnetic environment.

Applications of RF Testing

RF testing is crucial across a wide range of industries, each with its specific requirements and challenges. Here are some key sectors where RF testing plays a vital role:

1. Telecommunications

In the telecommunications industry, RF testing is essential for the development and deployment of mobile phones, base stations, and networking equipment.

Ensuring that these devices comply with regulatory standards and perform reliably under various conditions is critical for maintaining robust communication networks.

2. Consumer Electronics

From smartphones and tablets to smart home devices and wearables, RF testing ensures that consumer electronics operate correctly and safely.

This includes verifying wireless connectivity standards such as Wi-Fi, Bluetooth, and NFC, as well as assessing battery performance and electromagnetic emissions.

3. Automotive

Modern vehicles rely heavily on RF technology for applications such as keyless entry, infotainment systems, radar-based safety features, and vehicle-to-everything (V2X) communication. RF testing ensures that these systems function reliably and do not interfere with other electronic components in the vehicle.

4. Aerospace and Defense

In aerospace and defense, RF testing is crucial for the development and maintenance of communication, navigation, and radar systems.

These applications demand the highest levels of performance and reliability, as failures can have severe consequences. RF testing ensures that these systems meet stringent military standards and operate effectively in harsh environments.

5. Medical Devices

RF testing in the medical field ensures the reliability and safety of devices such as wireless patient monitors, implantable devices, and telemedicine equipment.

This is critical for ensuring accurate diagnostics, continuous patient monitoring, and reliable communication in healthcare settings.

Conclusion

RF testing is an indispensable part of the development and deployment of radio frequency devices. By ensuring compliance with regulatory standards, verifying performance metrics, mitigating interference issues, and ensuring safety, RF testing helps manufacturers deliver reliable, high-quality products to the market.

As RF technology continues to evolve and become more integrated into our daily lives, the importance of rigorous RF testing will only grow, ensuring that the devices we rely on perform flawlessly and safely.

0 notes

Text

Photovoltaic Waste Handling: E-waste Management in the UK

Photovoltaic (PV) solar panels are precious assets for the renewable energy sector. From opting for green energy to saving natural resources, solar panels have emerged as an integral power source in the country. The dilemma of photovoltaic waste handling surfaces when the panels reach the end of their cycle. While pounds of solar panels have already been replaced, thousands may end up in the garbage in the coming years. Considering the importance of recovering potential components for remanufacturing and the hazards of improper disposal, it is safe to contact certified recyclers. Recycling solar panel modules is the safest option to avoid environmental toxicity and rising landfills. Are you struggling with non-functional PV panels? We will guide you through the core aspects of managing defunct PV panels. Don't let non-operational panels hold you back.

Overview of PV Module Recycling in the UK

Recycling PV modules is the most convenient option at the end of productive life. Here are the reasons to consider recycling solar panels and avoid heaps of landfills.

#1. PV Panels are Hazardous E-waste

Dr. Vasilis Fthenakis, Department of Earth & Environmental Engineering and Founder and Director of the Center for Life Cycle Analysis (CLCA) at Columbia University, highlights the impact of lead halide perovskite (LHP) photovoltaics on the environment – soil, water, and air. Perovskite PV products contain toxic lead compounds. Exposure to LHP can cause multiple health issues in humans. These crystallographic substances can raise blood pressure levels, cause anaemia, and harm the foetus in pregnant women. Lead ingestion in children can lower IQ, retard physical and brain development, and affect hearing abilities. Recycling is the ideal option for removing solar panels from domestic and commercial premises without risky, accidental contamination. Professional recyclers leverage safe removal methods to prevent exposure of toxic elements to the surroundings.

#2. Recovering Precious Materials

The valuable materials salvaged from the old and inoperable photovoltaic modules can be repurposed for producing new solar panels. The e-waste comprises precious items, especially silicon, silver, and aluminium frames. Moreover, the panels consist of large quantities of glass and plastic, recovered for further use during disassembling. Up to 95% of the glass sheets extracted from the conveyor belt can be recycled. Hence, solar module recycling is a safe method of removing and repurposing valuable assets for future manufacturing.

#3. Alarming Rise of Landfills across the Country

The load of waste is constantly rising across 500 landfill sites in the UK. Every year, over 100,000 tonnes of cheap electronic goods are thrown into waste bins (according to a survey by Material Focus, a non-profit organisation). These items can be recycled to recover the resources for remanufacturing quality products. In the wake of overflowing garbage wastes and shortage of landfill space across the country, it is wise to recycle valued items rather than throwing away.

#4. Economic Growth Prospects of the Solar Panel Recycling Market

The growth of the global solar panel recycling market is estimated at £1.29 billion by 2028. There has been a massive switch to renewable and sustainable energy opportunities in the commercial zones in the last few decades. Large volumes of panels are about to reach the end of life in the next few years. Eyeing the responsible e-waste handling and imposition of WEEE regulations, the recycling industry is booming worldwide, and the UK is not an exception.

Wrapping Up,

Recycling is by far the most effective end-of-life management of PV modules. At least 80-95% of the solar panel components are recyclable, employing safe and permissible extraction methods. When the energy efficiency of worn-out solar panels drops, it is time to replace them with new modules. Rather than discarding it in the garbage, contact us for photovoltaic recycling. At Evolution Solar Recycling, the team of certified recyclers use state-of-the-art equipment for safe PV panel removal to prevent mishaps and accidental exposure to high-risk e-waste chemicals.

0 notes